For more than a decade, Kenya has been hailed and featured in reputable global headlines for it’s revolutionary mobile banking technology, M-PESA. I could be wrong on this but I believe M-PESA is one the greatest inventions/innovations in fintech and the only serious threat to the banking industry.

This subsidiary( it’s more of a subsidiary than a department) of Safaricom PLC has evolved for the last 14 years, from facing tonnes of criticism to being the leading mobile banking platform in Kenya. According to Safaricom’s 2019 financial year report M-PESA generated Sh74 billion in revenue. That was up from the Sh62.9 billion recorded in 2018. The telecommunications giant has 31.8million customers. Out of these, 22.6million are registered M-PESA users. The growth can be attributed to an increased number of users, higher velocity of funds within the ecosystem and adoption of new use cases.

According to the 2019 report, M-PESA has over 167,000 agents and over 123,000 Lipa na MPESA merchants. Lipa na M-PESA is a mobile bill and till service platform that enables making of cashless purchases in shops and supermarkets and cashless payment of utility bills, through M-PESA. In the 2019 financial year, Safaricom added 2.1 million active M-PESA customers. The mobile money service, however, reported a 10.6 per cent reduction on the average rate per person to person transaction, compared to 2018.

M-PESA now accounts for 31.2 per cent of service revenue, further accelerating displacement of Safaricom’s legacy business of airtime provision. The growth of M-PESA has been largely contributed by diaspora transactions that have come about by partnering with other global money transfer platforms like PayPal, Google Playstore, Western Union and AliExpress. According to Safaricom, through PayPal, customers made over 11,000 transactions monthly, over 5,000 monthly mobile apps purchase through Google Playstore and through Western Union M-Pesa customers can send money to over 500,000 cash agents and over three billion bank accounts worldwide. M-PESA Global brought in 33.7 per cent (Sh 101 billion) of all diaspora remittances transacted through M- PESA.

Safaricom says Fuliza, a credit facility by M-PESA, currently has 9 million users and transacted Sh29 billion in just three months from the time it was introduced. M-PESA’s Fuliza is the world’s first mobile money overdraft facility in partnership with two local banks KCB Group PLC and Commercial Bank of Africa.

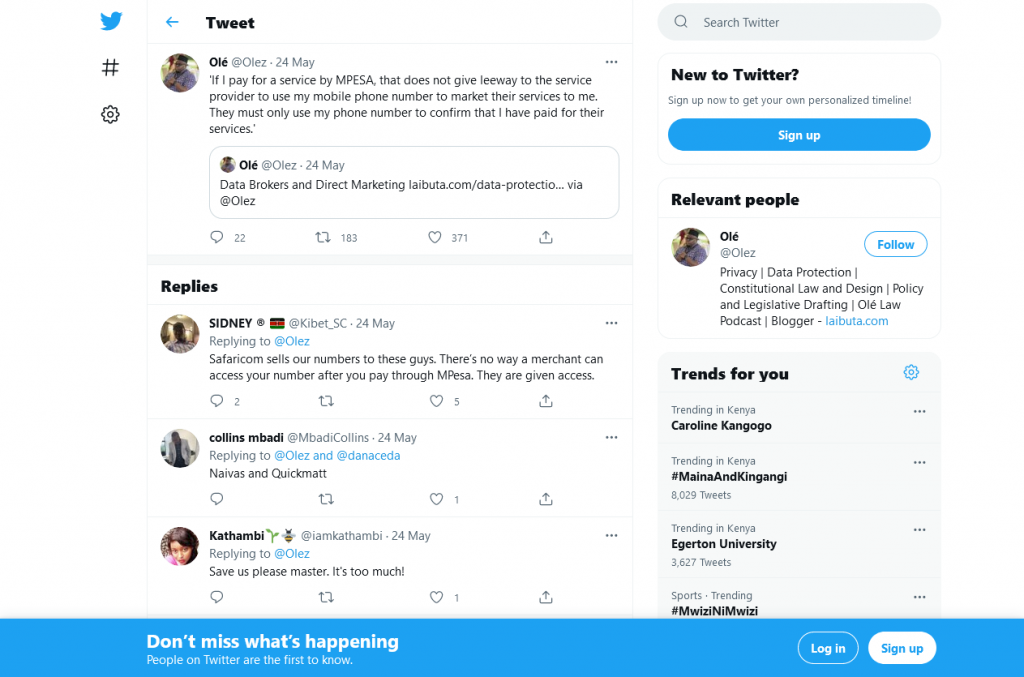

However, Safaricom has been accused of stealing ideas and breaching data privacy regulations . There has been allegations that the telecommunication giant is sharing customer M-PESA data to 3rd party merchants, with a section of Kenyans taking to social media to share their personal experiences and views on this

Normally, when you pay for utility bills or any service via M-PESA, the merchant receives your payment details( Name, Amount, Phone number) the same way you do when you send or receive money from a friend/colleague. The only slight difference is merchants can programmatically save that info into their database through the Daraja API for their future reference/consumption unlike a normal peer-peer transaction. This API powers most of the services Kenyans are enjoying like depositing money to bank accounts from M-pesa through a Paybill or Till number, STK push( a technology that initiates a payment automatically when paying for bills) among others. Kenyans have complained of receiving spam promotional messages from merchants as a result of this and even moved to court to block safaricom from sharing their payment details with merchants. This was a very wrong move that will see many Kenyans cry more than the berieved. I agree in some cases, merchants send irrelevant promotional messages but the telcos have given us a way to stop this by dialing *456*9*5# or chat with Safaricom Zuri on Whatsapp, Facebook and Telegram to stop unwanted promotional messages.

According to reports from undisclosed sources, Safaricom is about to bow to this pressure. This comes as the leading telecommunications firm moves to curb the trading of user information to advertisers or fraudsters.In the new messages, the firm will only display the first and last part of the message while concealing the identity of the user once a transaction is completed. This will include the first and last mobile phone digit numbers.

Now what Kenyans don’t seem to understand is the implications of this new move. This is what it means: You’ll be required to verify payments manually. Your billing accounts are linked with your m-banking phone numbers. If safaricom will not share the your phone number with merchant, the merchant system in this case could be your bank, favorite restaurant or cab like Uber, will not be able to tell who has paid and what product/service you have paid for . The only option will be verifying payment manually by entering the transaction number . So let’s assume M-pesa SMS gateway is having delays or someone standing next to you sees and crams that transaction number and types it faster than you, what will happen? your guess is just as right as mine. Again, just like in merchant case, when you send money to your son, daughter or friend you won’t receive their personal details like full names and mobile number. So if someone who shares similar first name with your son decides to register a phone number with last 3 digits as his, you’ll be conned and take days before realizing what happened. There are so many other loopholes that fraudsters will exploit to make sure Kenyans will beg Safaricom to restore the previous model